The Glazer-owned Manchester United achieved record operating profits for the 2013-14 season, while Chelsea FC become the first club to reach a 1.3bn for net debt as per report by Deloitte.

While it might have been a season to forget in 2013-14 for Manchester United on the pitch, off it, Deloitte’s annual football finance review has seen United post an all-time record operating profits of A?117 million (a 159m) for the season which saw manager David Moyes fired for poor performances of the team.

Tottenham Hotspur also delivered a record pre-tax profits of a 109m following the sale of Gareth Bale to Real Madrid, while Chelsea FC, who finished third in Jose Mourinho’s first season in charge, became the first club in the history of the Premier League to hit the A?1 billion (a 1.3bn) mark for net debt. This, despite Chelsea FC having a transfer policy of selling squad players to bring in money as illustrated in the sale of Andre Schurrle, Kevin de Brunye and Romelu Lukaku

During the 2013/14 season, Chelsea FC spent A?30 million on Willian and A?21 million on Nemanja Matic, with owner Roman Abramovich providing an additional A?57 million loan to the club he has owned since 2003 as they continue their reliance on the Russian billionaire.

Manchester United signing the record sponsorship deals and posting record profits mean they have no such reliance and Louis Van Gaal will be further hoping to splash the cash in the transfer market. Manchester United will also be further boosted by Champion’s League revenue should they negotiate the qualifying round. But, Manchester United still have debts of A?342m as a result of the leveraged takeover almost 10 years ago by the Glazers.

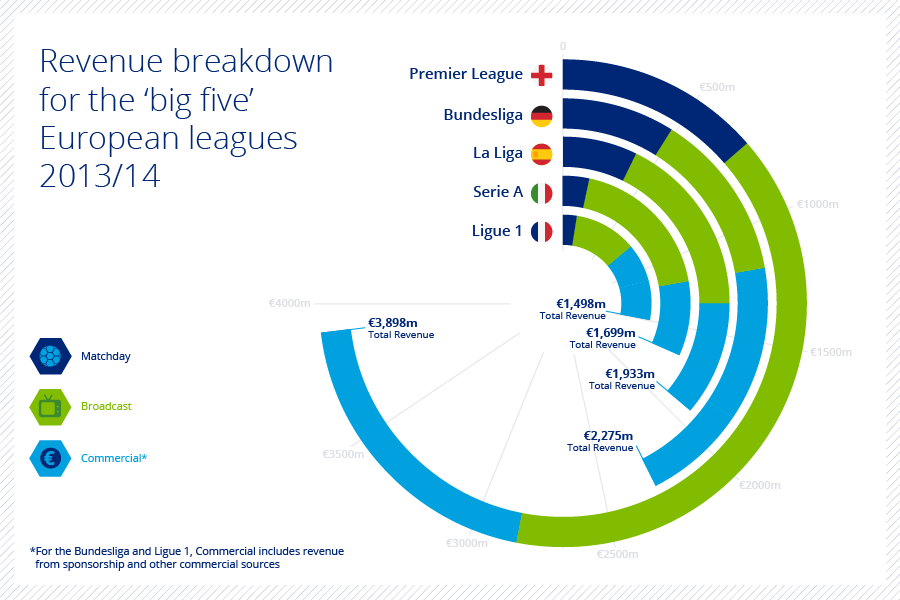

The Premier League back to the top as far as finances were concerned among Europe’s major leagues, with a record combined operating profits total of a 835m, almost treble that of the previous record set by the Bundesliga in 2012-13.

“The transformation of Premier League club profitability will fuel even greater global investor interest in Premier League clubs,” said Dan Jones, head of Deloitte’s Sports Business Group.

“With significant future revenue growth already secured through the recently agreed domestic broadcast rights deals from 2016-17 to 2018-19, as well as the success of cost control regulations, the risks associated with investment in Premier League clubs seem to be diminishing.”

Premier League Finances 2013-14 at a glance.

- Club revenues ranged from A?433m ( Manchester United ) to A?83m ( Cardiff City )

- Combined broadcast revenue up by 48%

- Commercial revenue rose by A?135m to A?884m

- Matchday revenues increased by 5% to A?616m

- Net debt was down by 6% to A?2.4bn

- Club wage bills increased by 7%

- 19 of the 20 clubs made an operating profit

- 14 of the 20 made a pre-tax profit

- The first season since 2004/05 in which no new stadiums opened

- Manchester City led capital spending – A?94m on the Etihad and its football academy

- Total owner investment at both Chelsea FC and Manchester City topped A?1bn at each since their respective takeovers

.